What We Look For

EBITDA

$500K–$2M

Region

U.S.-only

Industry

Recession-resilient, service-driven verticals

Ownership

Founder-owned, no succession plan

Structure

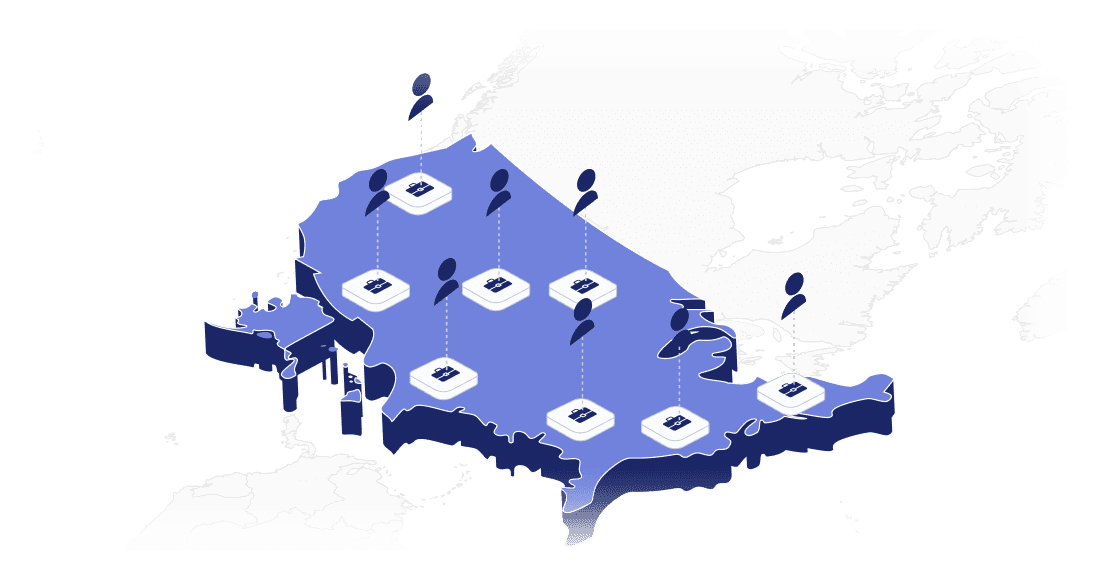

5-10% equity checks for 19% ownership.

Example Sectors:

Home services

Non-clinical healthcare

Transportation & logistics

Professional services

Manufacturing

MSPs

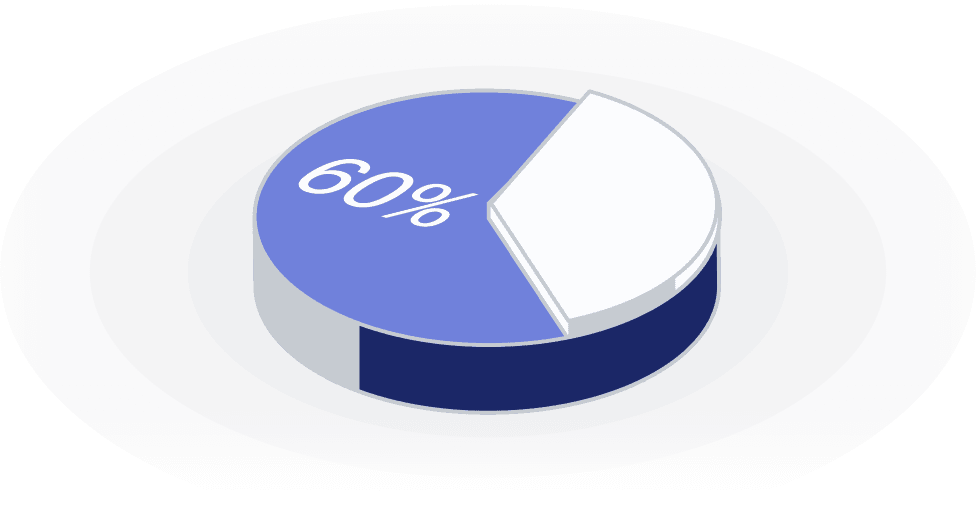

Why the Opportunity Exists

There’s a structural failure in lower-middle-market succession.

If just 10–20% of those firms shut down instead of selling:

3.2M–6.4M

jobs at risk

$1.3T+

in wages lost